FIVE R’s OF RETIREMENT

Education professionals understand the three R’s, says Dave Bernard. He is the author of the books; I Want to Retire and Navigating the Retirement Jungle and suggests five pillars for a happy retirement.

- Reward yourself. Do not put pressure on yourself. Be as busy or leisurely as you wish. That freedom is its own reward.

- Rejuvenate your life. With the pace of work, you can get locked in to certain behaviours and habits. Now’s the chance for a fresh start.

- Refocus your energies. You have time for things in life that may not have always received the full attention they deserved – your family, friends and health, not to mention your passions outside work.

- Renew your interests. Revisit old pastimes or pick up new ones, whatever engages you.

- Respect your limitations. “Try not to regret what you can no longer do, but instead rejoice at what you are still capable of,” says Bernard.

Retired Teachers of Ontario

www.rto-ero.org

Retired Teachers of Ontario www.rto-ero.org

PRE-RETIREMENT CHECKLIST

- Attend TRAF retirement seminars.

- Contact TRAF directly to receive personal information.

- Contact Revenue Canada concerning CPP and OAS to understand how they will affect you.

- Attend retirement seminars offered by other institutions such as a bank, investment houses, etc.

- Speak to a personal financial advisor on wealth management issues such as Estate planning; tax efficient investing; RRSP’s and RIF’s; legacies to family, institutions, charities.

- Speak to a lawyer about: wills, estate, medical power of attorney and living wills, financial power of attorney and legacies.

- Research appropriate health, dental, vision, travel care plans for your retirement years.

- Practise living on your retirement income for a year. Consider a sabbatical, a deferred salary leave or just a leave.

- Become debt free.

- Consider creating an emergency/slush fund.

- Consider planning for major purchases such as; a winter/summer home; a new vehicle; investment property; further education.

- Consult medical doctors about physical and mental health. Have a good understanding of your situation and life expectancy and probable quality of life.

- Talk to other retirees, especially those whose lifestyle you would like to have.

- Consider long term plans for self, spouse and dependents for housing, medical care, social interaction, spiritual care, physical activity, etc.

- Consider looking for a part-time job to fill your time and help with major purchases. Will you stay in the same field of work or look for something new? You will need to update your resume and complete a new criminal record check if it is required for your new employment.

- Talk to family about end of life issues; living wills, doctor assisted death; funerals or last wishes for remains; safety deposit box key location; financial information; institutions used, passwords, location of records and legal documents; doctors; how to deal with your electronic files.

- Consider the unpleasant what ifs; disability or loss of partner and necessary moves as you age; loss of mobility.

- Coordinate/plan your retirement with your partner’s retirement.

Courtesy of TARE, Thompson Association of Retired Educators

RESOURCES

• Retired Teachers’ Association of Manitoba rtam.mb.ca

• Canadian Association of Retired Teachers acer-cart.org

• Teachers’ Retirement Allowances Fund traf.mb.ca

• Department Test Supervisors – employment opportunities for retired teachers.edu.gov.mb.ca

• Canada Pension Plan (CPP) and Old Age Security (OAS) canada.ca

• Manitoba Seniors’ and Healthy Aging Secretariat gov.mb.ca

• Nicenet – National Initiative for the Care of the Elderly nicenet.ca

• Creative Retirement Manitoba crm.mb.ca

• Travel Canada – official site of the Canadian Tourism Commission. caen-keepexploring.canada.travel

• Work Overseas – Canadian Bureau for International Education. cbie.ca

• Zoomer Magazine – target audience 45+ everythingzoomer.com

• Good Times Magazine – Canada’s magazine for successful retirement. goodtimes.ca

RETIREMENT FROM A RETIRED TEACHER'S PERSPECTIVE

At an RTAM Chapter Presidents Meeting, retired teachers were asked what they would like to tell active teachers about retirement. The material provided below is informational in nature and not formal advice.

- Remember that you will retire whether you like it or not. Retirement is great if you prepare for it. Make sure that you have something to do like being part of an RTAM local group to get involved with other like-minded individuals.

- Financial planning is essential – be prepared.

- Plan for your retirement at least 5 years before you retire.

- Keep in touch with RTAM – KIT (publication), local RTAM chapter, be vigilant on retired teachers’ issues as a group.

- Many organizations expect retired teachers to be on call to help with community activities.

- Do things that you have always wanted to do.

- Travel – see the world.

- Socially, stay involved.

- Prepare yourself for “free” evenings – no schoolwork to do.

- Plan for it- retire to not from, enjoy it.

- Start saving early – pay yourself first.

- Be sure you have other income, so you are not relying solely on pension income i.e., RRSPs and investments.

- Have plans to keep active.

- Do not lose touch with other teachers – both active and retired. Consider other avenues for using your knowledge – work with adults, volunteer. Continue learning.

- Attend retirement seminars in each decade that you work and really pay attention to advice given about attaining the retirement that you desire.

- You will really need a focus, hopefully worthwhile.

- Check the TRAF pension options carefully. Note – if your partner dies – your teaching pension is reduced permanently.

- Do not use bridging with CPP – costs will go up and COLA will not keep up – so additional income later is beneficial.

- Understand that a) MTS no longer represents you the day after you retire. b) Your pension is insufficient to provide a good lifestyle. It is not fully indexed to cost of living increases – active teachers need to plan individual investments to supplement pension.

- Really check into Blue Cross/Johnson benefits.

- Do not make major decisions quickly (i.e., selling your home, moving, etc.)

- Be selective in your first year of retirement as to what you volunteer to do. Find something you like to do and do it.

- Think about how you are going to fulfill your need to be relevant (needed, and a contributing member of society).

- Discuss your retirement “budget plans” with someone who will critique it positively for you.

- Do not rush into retirement because of internal/external stressors – retire on your “own terms”.

- Do not wait to enjoy life when “you retire” – retirement is just an extension of enjoying life – another variation.

- Retirement is not an “event” – it is part of a journey.

- Keep a list of goals that range in easily attainable to difficult ones. (Bucket List).

- If planning to start another business after retirement – start while you have a steady income.

- Rewrite your resume highlighting skills learned from teaching. You have many skills that are wanted in other aspects of your community.

- Invite an active teacher to attend a chapter activity (if possible).

- Involvement and vigilance after retirement is still essential.

- Try to get rid of clutter long before your next move.

- Be debt free when you retire.

- Get professional advice.

- Have fun/do it now!

- Retire your mortgage early.

- Do not buy “work” clothes in the year before you retire.

- Get physically active before retirement and continue after your retirement.

- Be aware of how much you will lose off your monthly pension if you job share. Do not job share unless you can squeal your tires out of the parking lot at dismissal.

- Good idea to transition out of full time work with part time before retiring completely.

- Retire when you are happy with what you are doing.

- No dental, no glasses. Get it done as much as possible before you retire.

- When you are thinking of retiring in a few years, ask TRAF for a printout of your projected pension amounts. Pick the most likely and live on that amount. Bank the rest and you will have a little nest egg – and if you can live on your “projected pension” you can afford to retire.

- Do not retire the same year as your spouse.

- The best thing about retirement is that you almost never have to set your alarm clock.

- Buy big ticket items before you retire.

- Be ready to live on a smaller income.

- What I enjoy most is the freedom and flexibility to choose how I want to spend my days.

- Have not heard anyone regret retirement.

- Attend the pre-retirement seminars – they give valuable information.

- Give yourself time to enjoy retirement during the first years – do not get too involved in volunteering or subbing.

- A lot of information is available from TRAF, no need for educators to be oblivious to retirement.

- Do not feel obligated to accept sub jobs – you can say no without guilt.

- Manage your personal finances carefully – know your financial situation clearly. Plan for daily living – priorities, activities.

- The importance of health, wellness, and economic security concerns. Do not just focus on the pension options.

- Watch your subbing days.

- It could be a long period and your health rarely gets better as you age, so do those active things early on in your retirement.

- Select your retirement activities carefully – you may be creating unrealistic expectations for yourself.

- Stay involved in retirement – there is a world of new experiences out there and your teaching skills will come in handy in many of them. Try something new.

- Stay active and involved with the community.

- I did not realize how much fun it would be and how much more relaxed I would be.

- Your pension does NOT increase at the rate of your food, housing, utilities, etc.

Retirement is the time when you, rather than others, finally get to plan your life.

The Retired Teachers’ Association of Manitoba does not provide tax, legal, accounting, health, lifestyle, or any other form of advice. All material and information offered on the RTAM website is for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal, accounting, health, lifestyle, or any other form of advice. Readers should consult appropriate professionals to determine what may be best for their individual needs.

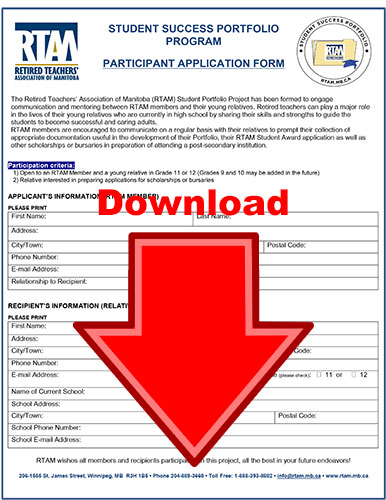

As part of our New Horizon for Seniors Grant, we allocated some funds for a research study to help us determine the effectiveness of our program. We recently were matched with a U of M Masters student to be our researcher. Andrew Augustyn is very excited to do this research as he is interested in the theme of mentoring for his M.Ed. thesis. RTAM has sent out letters of invitation to hold interviews on his behalf to those who have signed up for the program. He will be doing two interviews this fall as part of his Qualitative Research Course and then completing our research with eight more interviews in February in order to meet our Grant Report requirements due in March. Enjoy reading his biography below.

As part of our New Horizon for Seniors Grant, we allocated some funds for a research study to help us determine the effectiveness of our program. We recently were matched with a U of M Masters student to be our researcher. Andrew Augustyn is very excited to do this research as he is interested in the theme of mentoring for his M.Ed. thesis. RTAM has sent out letters of invitation to hold interviews on his behalf to those who have signed up for the program. He will be doing two interviews this fall as part of his Qualitative Research Course and then completing our research with eight more interviews in February in order to meet our Grant Report requirements due in March. Enjoy reading his biography below.